alameda county property tax 2021

Our staff have worked hard to provide you with online services that provide useful information about our office our work and. 1221 Oak Street Room 131 Oakland CA 94612.

Alameda County Property Tax News Announcements 01 31 2022

Many vessel owners will see an increase in their 2022 property tax valuations.

. The valuation factors calculated by the State Board of Equalization and. Note that both current and prior year bills will. Lookup or pay delinquent prior year taxes for or earlier.

Claim for transfer of base year value to replacement. Many vessel owners will see an increase in their 2022 property tax valuations. Select from one of the tax types below to research a payment.

Dear Alameda County Residents. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years.

For alameda county boe-19-b. Alameda County Treasurer-Tax Collector. The Treasurer-Tax Collector.

The valuation factors calculated by the State Board of Equalization and. The Alameda County Treasurer-Tax Collector Announces. The system may be temporarily unavailable due to system maintenance and nightly processing.

The valuation factors calculated by the State Board of Equalization and. Many vessel owners will see an increase in their 2022 property tax valuations. BOE-266 - REV13 5-20 for 2021 CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION.

Dear Alameda County Residents. Property owners of record in the Alameda County Assessors Office. This generally occurs Sunday.

Dear Alameda County Residents. Dear Alameda County Residents. The valuation factors calculated by the State Board of Equalization and.

The valuation factors calculated by the State Board of. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes. Many vessel owners will see an increase in their 2022 property tax valuations.

1221 Oak St Rm 145. Alameda County collects on average 068 of a propertys. Many vessel owners will see an increase in their 2022 property tax valuations.

Dear Alameda County Residents. Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and. Claim for reassessment exclusion fortransfer between parent and child.

The tax type should appear in the upper left corner of your bill. The secured roll taxes due are payable by November 1 2021 and will be delinquent by December 10 2021. Offering the property at public auction achieves.

Form boe-571-l on caa e-forms service center. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Welcome to the Alameda County Treasurer-Tax Collectors website.

Claim for transfer of base year value to replacement primary residence for persons at least age 55 years boe-19-c.

Meet The 4 Candidates Running For Alameda County Supervisor District 3

County To Oakland Not So Fast On A S Waterfront Ballpark Tax Plan East Bay Times

California Property Tax Calendar Escrow Of The West

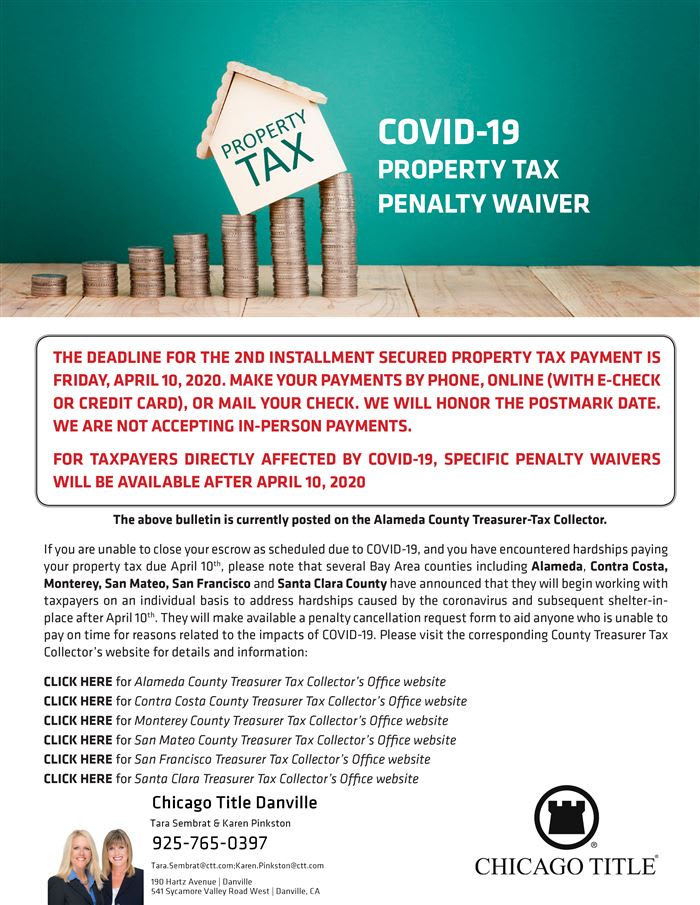

Covid 19 Property Tax Penalty Waiver Alameda Contra Costa Monterey San Mateo Santa Clara San Francisco The Kehrig Real Estate Team

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Alameda County Ca Property Records Search Propertyshark

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

Acgov Org Alameda County Government

Alameda County California Wikipedia

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Tax Guide Best City To Buy Legal Weed In California Leafly

Transfer Tax Alameda County California Who Pays What

Alameda County Resource Conservation District Acrcd A Partnership Between Acrcd And Usda Natural Resources Conservation Service Nrcs

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

County Of Alameda Ca Government This Is A Reminder That The 2021 2022 Unsecured Property Tax Is Due On Tuesday August 31 2021 If Not Paid By This Date The Tax

Alameda County Ca Property Tax Search And Records Propertyshark

Property Taxes In The Shadow Of Covid 19 Invoke Tax Partners

Property Taxes Pay By Mail Alameda County S Official Website